Fraud can happen at any time, to anyone.

The Ontario Association of Chiefs of Police (OACP), in partnership with the Canadian Anti-Fraud Centre (CAFC) and the OACP’s Public-Private Security Liaison Committee (PPSLC), is pleased to provide you with a new crime prevention resource, The Mass Marketing Fraud Webinar: Recognize, Reject and Report. This 30-minute webinar discusses the “3 R’s” of mass marketing fraud with representative, Acting Detective Sergeant John Armit from the CAFC.

This public awareness and education resource has been created as a fraud prevention tool.

What is the Canadian Anti-Fraud Centre?

The CAFC is Canada’s central repository for data, intelligence and resource material that relates to fraud. It does not conduct investigations but provides valuable assistance to law enforcement agencies all over the world by identifying connections among seemingly unrelated cases. It is jointly managed by the Royal Canadian Mounted Police, the Competition Bureau Canada and the Ontario Provincial Police (OPP).

The CAFC is composed of over 30 full-time employees, including OPP employees. They also have a Senior Support Unit composed of 40+ senior and student volunteers who offer guidance through follow-up calls to seniors at risk or victims of fraud.

To learn more about the important work the Canadian Anti-Fraud Centre is undertaking, please visit their website.

What is Mass Marketing Fraud?

The term "mass-marketing fraud" refers generally to any fraud scheme that uses one or more mass-communication methods – such as the Internet, telephones, the mail, or in-person meetings – to fraudulently solicit or transact with numerous prospective victims or to transfer fraud proceeds to financial institutions or others connected with the scheme. Mass-marketing fraud schemes generally fall into two broad categories: (1) schemes that defraud numerous victims out of comparatively small amounts, such as several hundred dollars, per victim; and (2) schemes that defraud comparatively less numerous victims out of large amounts, such as thousands or millions of dollars per victim.

Source: Department of Justice USA

Types of Mass Marketing Fraud:

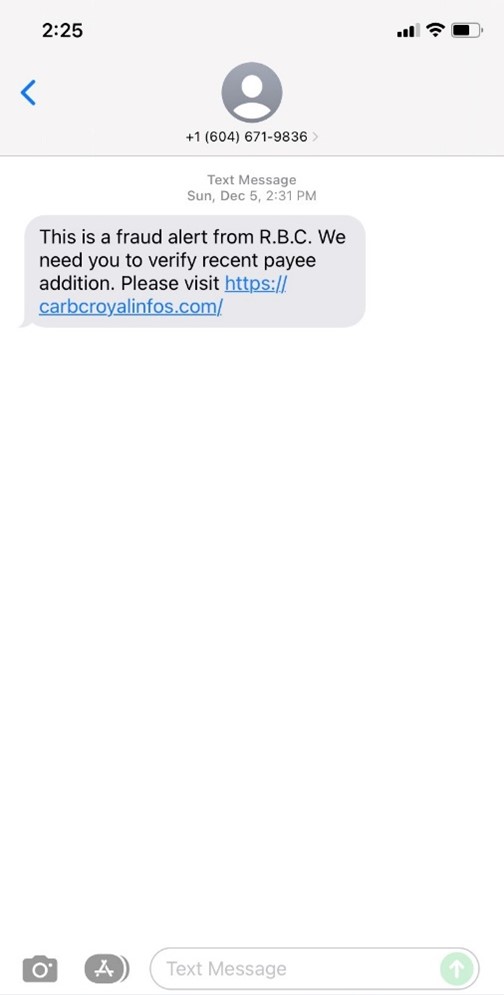

Phishing

You receive a fraudulent text or email that looks like it comes from a legitimate company, asking you to click on a link that brings you to a fake website. The website often can be made to look like your financial institution's website, so you do not notice the scam.

You receive a fraudulent text or email that looks like it comes from a legitimate company, asking you to click on a link that brings you to a fake website. The website often can be made to look like your financial institution's website, so you do not notice the scam.

Fraudulent Telemarketing

Telemarketing scammers solicit funds for fake charities or fraudulent investments. The caller asks about you and uses your answers to manipulate you into a quick sale. To be safe, never invest, donate or make purchases on the phone unless you make the call yourself or can validate the company's existence.

Steps You Can Take To Protect Yourself (The 3 R's)

Recognize

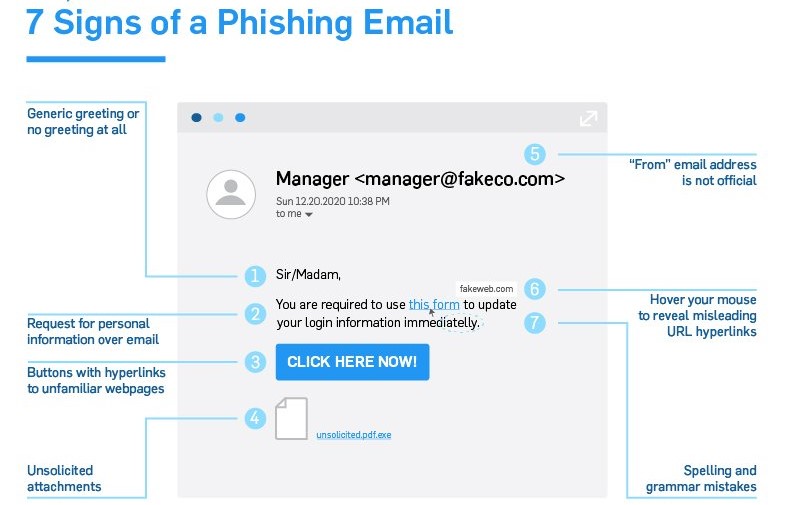

7 biggest red flags you should check for when you receive an email or text:

7 biggest red flags you should check for when you receive an email or text:

- Urgent or Threatening Language

- Requests for Sensitive Information

- Anything Too Good Too Be True

- Unexpected Emails

- Information Mismatches

- Suspicious Attachments

- Unprofessional Design

Protect your identity at all times. Never give out your personal information including:

- Your name

- Your address

- Your birthdate

- Your Social Insurance Number (SIN)

- Your credit card or banking information

- Never send money to anyone you don’t know or trust.

- You could receive fraudulent communications from a phone call, letter, text message or online refund form

- Ask for identification and be assertive.

- Beware of current scams, spam email and tactics

- Beware of free downloads and requests for passwords

- Be aware of current scams and tactics by following the Canadian Anti Fraud Centre on social media or via their website

Reject

Trust your instincts. If you receive a suspicious email, delete it. If you question the legitimacy of a telephone call from an unfamiliar source, hang up. If you get something in the mail asking you to forward personal information or credit card details, throw it in the recycling bin.

- Request information in writing

- Hang-up the phone

- Don't be afraid to say no!

Report

Step 1: Gather all information about the suspected fraud

Step 2: Report the incident to local law enforcement

Step 3: Report the incident to the Canadian Anti-Fraud Centre or the Competition Bureau

Step 4: Report the incident to the financial institution that transferred the money

Step 5: Notify the website where the fraud took place (if applicable)

Step 6: Place flags on your accounts and check your credit report

Why is Reporting You're a Victim of Crime is Important?

The Canadian Anti-Fraud Centre estimates that less than 5% of the total number of fraud victims report their experiences to law enforcement agencies in Canada. By reporting a scam, you provide law enforcement with the information they need to stop fraudsters and help prevent others from becoming victims. The information you provide is important!

Resources are available for Canadians who have been deceived or defrauded, or who encounter suspicious activity that may be fraudulent. Consumers can contact local law enforcement authorities as a first step. Reporting fraudulent activity helps agencies identify trends, monitor risks and take action.

Scams and cybercrimes can happen to anyone, anywhere, at any time.

Report to the Canadian Anti-Fraud Centre

- Report online

- Report by phone - 1-888-495-8501